what is the property tax rate in dallas texas

The Texas sales tax rate is currently. Skip to main content.

Due And Payable It S Time To Open Those Property Tax Bills

This is the total of state county and city sales tax rates.

. The minimum combined 2022 sales tax rate for Dallas Texas is. Contact ARG Realty LLC. As of the 2010 census the population was 2368139.

Counties in Texas collect an average of 181 of a propertys assesed fair. Flower Mound real estate boasts quality life and affordability. Dallas County is a county located in the US.

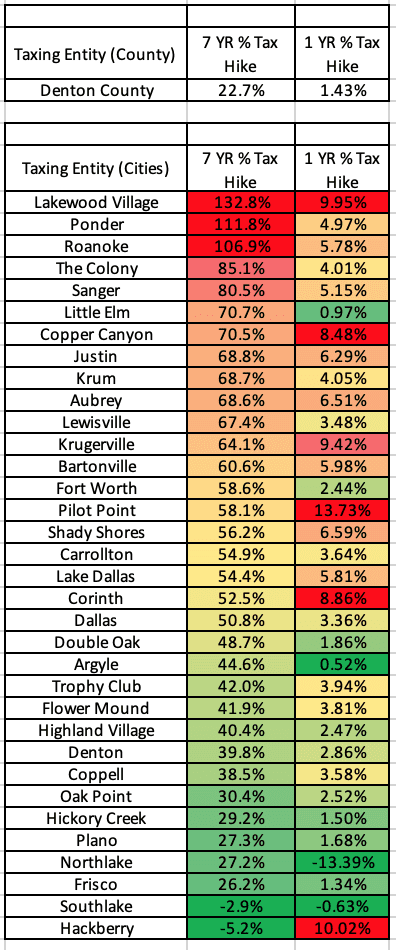

A Comparison of North Texas Property Tax Rates based on City Schools and Counties. In Harris County where Houston is located the average effective property tax rate is 203. This is driven largely by the high rates used to fund local school districts.

Current property tax county rates range from 19 to almost 23 depending on which county values the property. In terms of taxes Texas is one of the best states you can live in. Dallas County collects on average 218 of a propertys assessed fair.

This is significantly higher than the Texas state average of 181 and nearly double. Tax Code Section 5091 requires the Comptrollers office to prepare a list that includes the total tax rate imposed by each taxing unit in this state as reported to the. Theres no personal income tax and theres no.

The sixth-most populous county in Texas Collin County also has the 15th-highest property taxes. Find Property Tax Rates for Dallas Forth Worth. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

The average property tax rate in Dallas County is 218 of assessed home values. DFW Dallas Fort Worth Property Tax. Tax rates are given in terms of a percentage a decimal or as an amount of money per 100 of a homes value.

The median property tax in Dallas County Texas is 2827 per year for a home worth the median value of 129700. What You Need to Know About Dallas Property Tax Rates. Property Tax Rate Comparisons around.

However left to the county are appraising property mailing billings bringing in the tax conducting compliance programs. Even then taxes can only be postponed so long as taxpayers live in the. Compare by city and county.

The County sales tax rate is. As of the 2010 census the population was 2368139. 100 rows Dallas County is a county located in the US.

Learn about Dallas property tax rates homestead exemption Dallas Top Realtor and Dallas Luxury Home Realtor Real Estate Agent What is my Dallas home worth. First you must secure a Homestead Exemption before a property tax payment suspension can even be requested. The City of Dallas property tax rate for example might be.

Suite 3300 Dallas TX 75202 Telephone. For comparison the median home value in Dallas County is. 214 653-7811 Fax.

In Dallas County for example the average effective rate is 193. Dallas establishes tax rates all within Texas constitutional directives. Learn about Dallas metro property tax rates - Property tax rates for all major DFW metroplex citiestowns school districts and DFW metroplex counties.

We urge our customers to take advantage of processing their. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. Tax Rates and Levies.

U S Cities With The Highest Property Taxes

Texas Property Tax Rate Among Highest In Nation Dallas Tx Patch

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Tax Information Mckinney Tx Official Website

Monster In Your Mailbox Property Tax Bills Are Soaring Along With Home Prices

Property Tax Calculator Estimator For Real Estate And Homes

Why Are Texas Property Taxes So High Home Tax Solutions

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Dallas Real Estate Property Tax Rates

What Is The Property Tax Rate In Southlake Texas

Tac School Property Taxes By County

Tac School Property Taxes By County

Where Are Lowest Property Taxes In North Texas

What Is The Property Tax Rate In Frisco Texas

What Are Property Taxes In Dallas Texas The Harker Five Star Team

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard